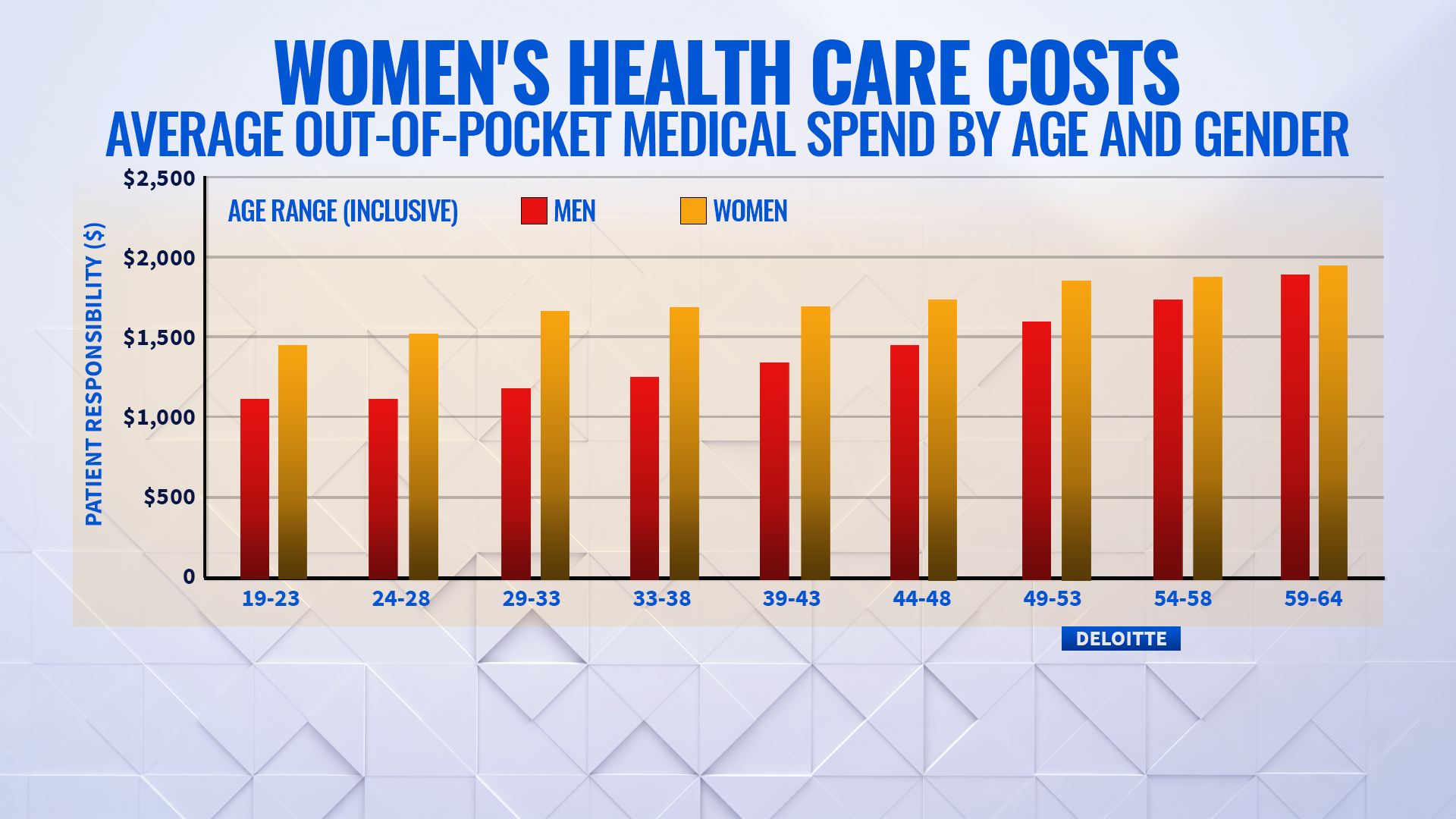

Working women in the U.S. spend an average of $266 more per year out of pocket on health care costs than men, a new report from Deloitte said.

Collectively, women in the U.S. spend $15.4 billion more in out-of-pocket expenses than men. Even when excluding maternity care, women ages 19-64 spend more than men on average.

"Our analysis highlights a hidden financial burden on women that can not only impact their pocketbook but potentially their health. Financial stressors can lead to health problems and delays in care which can further perpetuate a cycle of preventable health care consumption thus compounding expense. As leaders in business, health care, and society, we have an opportunity to make intentional efforts to close this gap," said Kulleni Gebreyes, chief health equity officer with Deloitte.

The new report notes that employers are required to offer health care at the same rate for men and women, but premiums are only one facet of overall costs.

SEE MORE: Digital health care helping patients with cancer cut medical costs

The report indicates that employers could close the gap by increasing benefits for women by $12 a month.

"Our health care system has done a great job driving equity for access, from the ACA making pregnancy an essential health benefit, to rules around mental health parity. Equity in benefits is the next challenge to address because benefits should be designed to support every person," said Andy Davis, principal of health care practice at Deloitte. "Women's care needs are different than men, and health care insurers and employers have an opportunity to examine and redesign benefit coverage to reduce the financial burden on women, close the benefit gap, and advance health and well-being for everyone."

In 2022, KFF released findings that said women were more likely to have gaps in coverage than men.

According to the report, 31% of women said their plan did not cover care they thought was covered, compared to 26% of men. The report also found that 29% of women said their plan would not cover prescription medication, compared to 21% of men.

Trending stories at Scrippsnews.com