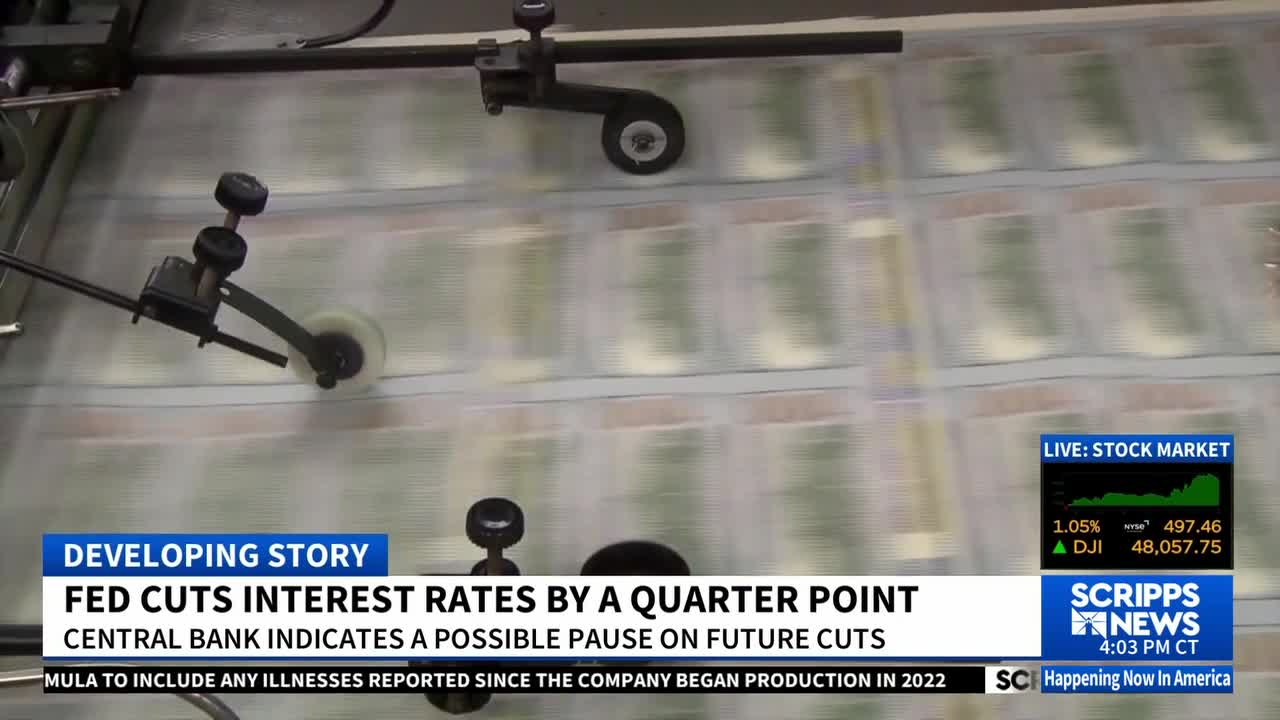

The Federal Reserve cut its benchmark interest rate Wednesday for the third time this year, lowering it by a quarter point and signaling it expects just one reduction in 2026 and likely another in 2027.

Growing dissent at the Fed

The move appears to signal that a majority of Federal Reserve board members think a rate cut will help boost a weaker labor market.

But once again, the board's members were not in agreement.

For the fourth straight meeting, at least one member dissented.

Stephen Miran, the Board of Governors member who President Trump appointed to join the board earlier this year, voted for lowering the rate by half a point.

Austan Goolsbee, the president of the Federal Reserve Bank of Chicago, and Jeffrey Schmid, the president of the Federal Reserve Bank of Kansas City, each voted for no change to the interest rate.

It's the first time since 2019 that three board members dissented.

Dissent was also visible in the board members' forecasts for interest rate cuts next year.

Seven members forecast no cuts or rate hikes next year; four projected one cut; four projected two cuts; and four projected more than two reductions.

IN CASE YOU MISSED IT | Trump announces a $12B aid package for farmers hit hard by his trade war

“This was a very difficult meeting for the Federal Reserve,” Said Thomas Stockwell, an assistant professor of economics at the University of Tampa. “There was a lot of evidence that suggested that a rate cut was needed, but there is also a lot of evidence that suggested a rate cut wasn't needed.”

Stockwell says the decision was part of a balancing act to carry out the Federal Reserve’s dual mandate to keep prices steady and support a strong job market.

Typically, the bank cuts rates to boost a faltering labor market.

“They're more worried about keeping the unemployment side of the equation in check and not letting the labor market get much worse than it is right now,” Stockwell said.

New data released Tuesday showed employers laid off almost 1.9 million workers in October, the most in a month since January 2023.

Meanwhile, year-over-year inflation remains at 3% according to the latest data from September.

For consumers, another cut means the cost of borrowing money could come down. That may happen in the form of lower interest rates on home equity loans and credit cards.

But a cut also risks fanning inflation.

That could make it more challenging for the Trump administration to promote a new focus on affordability.

“I have no higher priority than making America affordable again, and that’s what we’re going to do,” President Trump said during a rally in Pennsylvania on Tuesday.

The president has touted his work on the economy, but many Americans are still facing an affordability crisis.

More than nine in 10 U.S. adults say inflation is still an issue, according to a survey from WalletHub.