LAS VEGAS (KTNV) — The new massive $1.9 trillion COVID-19 relief bill was signed by President Biden on Thursday, a day before he was originally scheduled to sign.

The bill will result in $1,400 stimulus relief payments being sent to individuals making $75,00 or less and couples earning up to $150,000.

The checks are expected to start going out within days, maybe as early as this weekend, and most people should receive the money by the end of the month.

Stimulus checks will start hitting bank accounts as early as this weekend, @PressSec says. Previously officials had only estimated they would go out this month.

— Kaitlan Collins (@kaitlancollins) March 11, 2021

Partial payments will go to individuals making less than $80,000 and couples making less than $160,000. Because of the new limits, many people who received full stimulus checks in the past may not receive one this time or may only receive a partial payment.

The new bill also includes a child tax credit that will give some families $3,600 per child under the age of 6 and $3,000 per child between the ages of 6 and 18. Students up to the age of 23 will also be considered a dependent this time.

Additionally, families may also receive additional money for other adult dependents such as an elderly parent or disabled adult child.

RELATED: COVID-19 relief bill and your taxes

The benefits begin to phase out for heads of household making more than 112,500 annually and couples earning more than $150,000 a year.

The median household income in 2019 was $68,703, according to the U.S. Census Bureau. That means most American will receive a check.

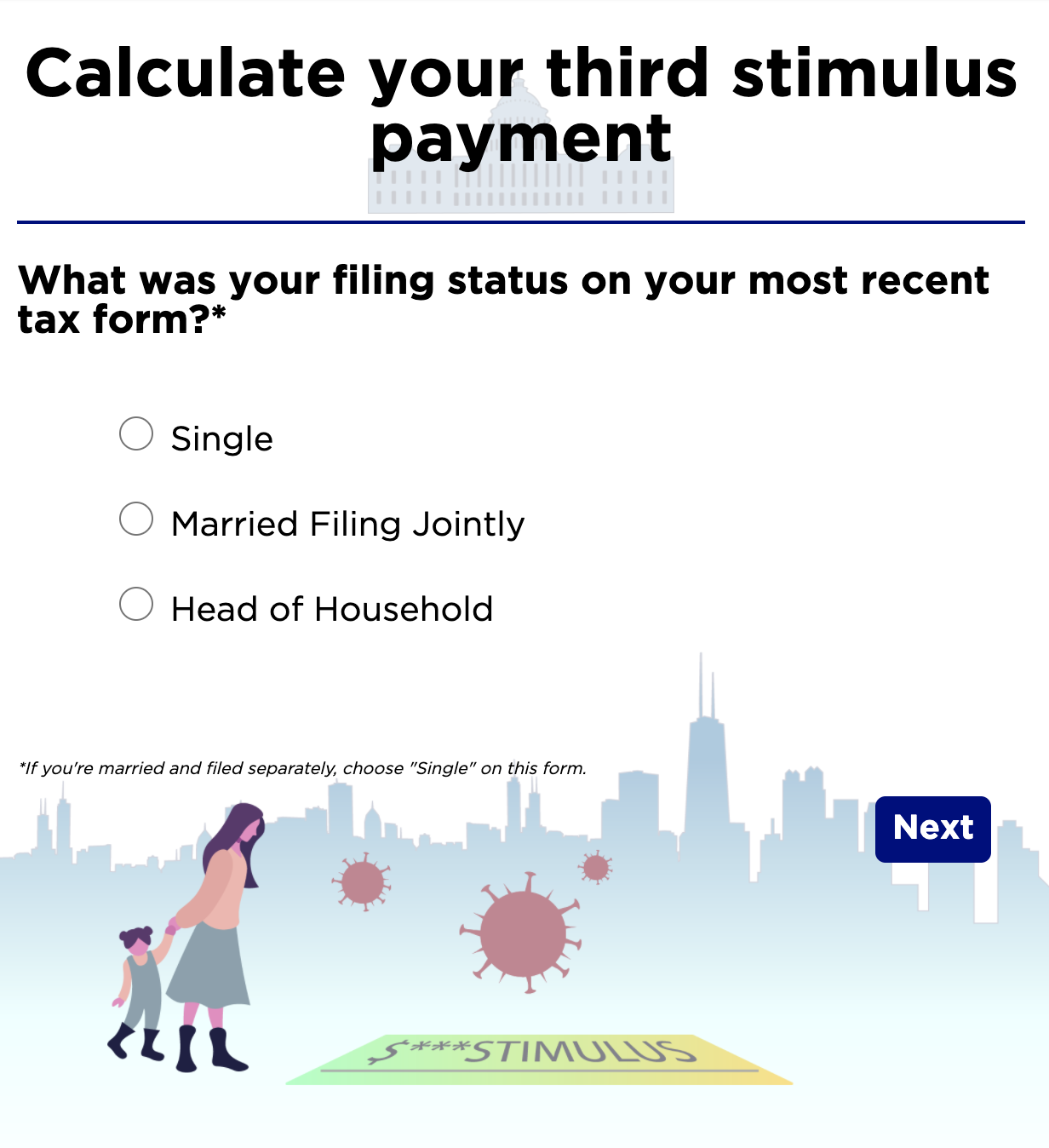

Use this tool from ABC News' data journalism team to see how much you might receive as part of the new stimulus package.

CLICK HERE TO USE THE CALCULATOR

Taxpayers who have direct deposit set up with the IRS will see checks first. Others may receive a paper check or a debit card in the mail.

Taxpayers will be able to track the status of their payments by going to the Get My Payment online portal.

RELATED: 25% of kids in the US are struggling to find regular meals. The stimulus bill aims to change that.

In addition to the stimulus checks, those who are receiving unemployment checks from the federal government will continue to do so through Sept. 6 at $300 per week. That’s on top of what beneficiaries are getting through their state unemployment insurance program. The first $10,200 of jobless benefits accrued in 2020 would be non-taxable for households with incomes under $150,000.

Additionally, the new bill provides a 100% subsidy of COBRA health insurance premiums to for laid-off workers.